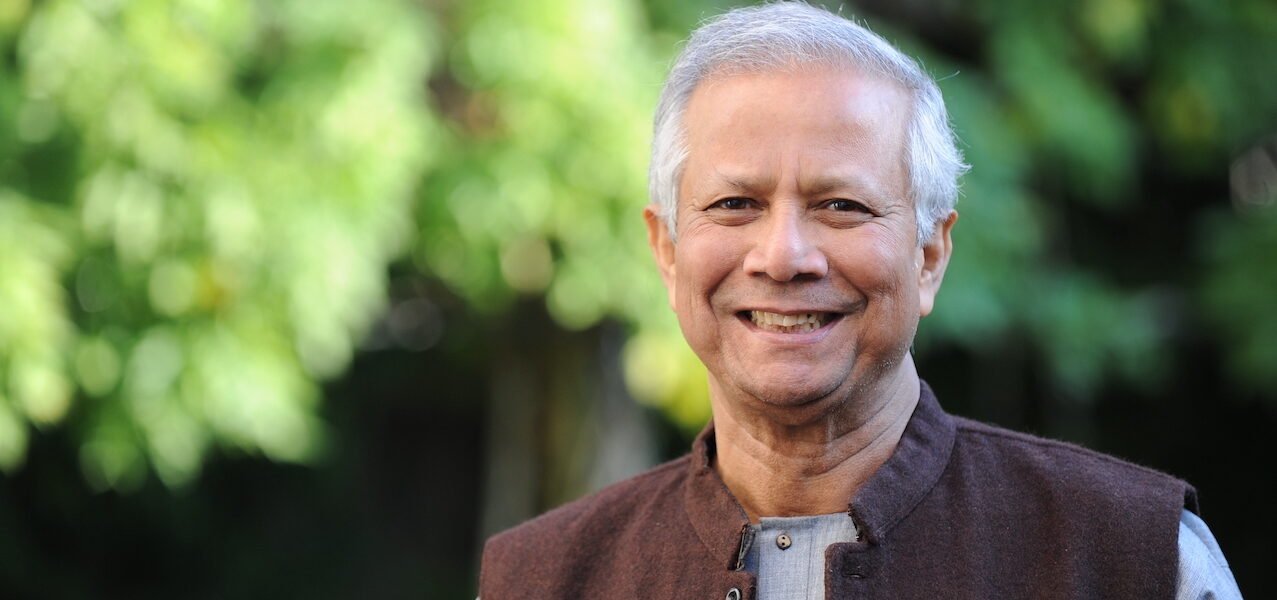

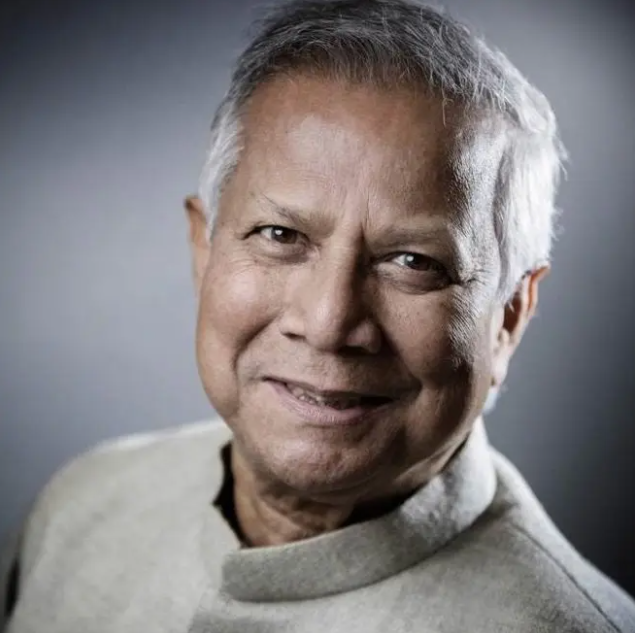

Muhammad Yunus, born on June 28, 1940, in Chittagong, East Bengal (now Bangladesh), is a celebrated Bangladeshi economist and the visionary founder of the Grameen Bank. This institution pioneered the concept of microcredit, providing small loans to impoverished individuals lacking collateral, thereby fostering financial independence and self-sufficiency. In recognition of their groundbreaking work, Yunus and the Grameen Bank were jointly awarded the Nobel Peace Prize in 2006.

Early Life and Education

Yunus’s academic journey began in Bangladesh, where he taught economics at Chittagong University from 1961 to 1965. He then received a Fulbright scholarship, which took him to the United States. There, he studied at Vanderbilt University, earning a Ph.D. in economics in 1969 and taught until 1972. Upon returning to Bangladesh, he led the economics department at Chittagong University and began investigating poverty’s economic dimensions amidst a severe famine in 1974.

Founding Grameen Bank

Realizing that traditional agricultural training was insufficient for the landless poor, Yunus concluded that what they needed most was access to financial resources to start small businesses. Conventional moneylenders charged exorbitant interest rates, trapping the poor in a cycle of debt. In 1976, Yunus initiated a microloan program, designed to meet the financial needs of Bangladesh’s poor. Borrowers, often with loans as small as $25, formed lending groups whose mutual support and peer pressure ensured high repayment rates. In 1983, the Bangladesh government recognized the success of this initiative, transforming it into an independent bank with a minority government stake. The Grameen model inspired similar microlending initiatives worldwide.

Political Involvement

In February 2007, Yunus ventured into politics, forming the Nagorik Shakti (Citizen Power) party, aiming to address corruption and restore good governance amidst political turmoil between the Awami League and the Bangladesh National Party. However, by May 2007, citing a lack of support, Yunus abandoned his political aspirations.

Controversies and Challenges

In 2010, the documentary “Caught in Micro Debt” scrutinized Yunus and the Grameen Bank, accusing them of misappropriating Norwegian funds. Although Norwegian officials later cleared both parties, the Bangladesh government launched its investigation. In 2011, Yunus was removed as managing director of Grameen Bank by the central bank, citing the mandatory retirement age of 60. Yunus, who had turned 60 in 2000, challenged this decision in court but ultimately failed to overturn it.

Publications and Honors

Yunus authored several influential books, including “Building Social Business: The New Kind of Capitalism That Serves Humanity’s Most Pressing Needs” (2010) and “A World of Three Zeroes: The New Economics of Zero Poverty, Zero Unemployment, and Zero Net Carbon Emissions” (2017). His accolades include the Independence Day Award (Bangladesh, 1987), the World Food Prize (United States, 1994), and the U.S. Presidential Medal of Freedom (2009). He was also the inaugural recipient of the King Hussein Humanitarian Award (Jordan, 2000).

Microcredit and its Global Impact

Microcredit, as institutionalized by Yunus through the Grameen Bank in 1976, extends small, collateral-free loans to nontraditional borrowers, primarily the poor in rural or underdeveloped areas. This system, backed by community support, encourages timely repayment and has helped millions rise from poverty. By 1996, Grameen had extended credit to over three million borrowers, becoming Bangladesh’s largest bank with more than 1,000 branches.

The success of Grameen’s model led to the adoption of similar programs in countries like Bolivia and Indonesia, supported by foundations, religious organizations, and NGOs. However, not all microlending programs have adhered to Grameen’s principles; for instance, the Mexican bank Compartamos faced criticism for high interest rates.

Conclusion

Muhammad Yunus’s innovative approach to microcredit has transformed the lives of millions, providing a model for poverty alleviation worldwide. Despite facing significant challenges and controversies, his legacy as a pioneer in microfinance and social business remains intact. The Grameen model continues to symbolize an effective means of empowering the poor, demonstrating that financial inclusion can be a powerful tool for social change.